'The Times of India' brings you 'Hack of the Day' — a new weekday-series of quick, practical solutions to everyday hassles. Each hack is designed to save you time, money or stress, using tools and features within your reach — from government websites to everyday apps. In simple words it is: Simple fixes for smarter living.

A Permanent Account Number (PAN) card is more than just a piece of ID; it's an essential government document crucial for virtually all financial activities in India. Indian citizens need it to open bank accounts, register property, file taxes and much more. With India becoming a digital-first economy, scammers can find ways to steal information and misuse your PAN card.

Here in this article, we’ll understand what PAN card fraud is and how to check whether your PAN number is being misused by someone else.

What is PAN card fraud

In simpler terms, a PAN card fraud is the unauthorised use of an individual's PAN. Once fraudsters have your number, they can engage in a range of illegal activities, including identity theft, creating unauthorised bank accounts, securing fraudulent loans or credit cards, executing illegal transactions and even filing false tax returns. Such misuse can lead to severe financial losses and legal trouble for PAN card holders.

How to check if your PAN card has been misused

Regularly checking your credit score is the best way to catch fraud. Here are two ways you can check whether someone else is using your PAN.

Method 1:

Open your UPI app like GPay or CRED on your phone

Look for option that allows you check your Credit Score

Tap on it and give necessary access to the app

The app will display your score. Look for ‘Full Report/ Report’ option

When you get the report, look for any unknown loans, credit card applications or sudden inquiries. These pointers can suggest that your PAN may have been used without your knowledge.

Also read: Hack of the day: Set app time limits to stop endless scrolling

Method 2:

You can also check your Credit Score online:

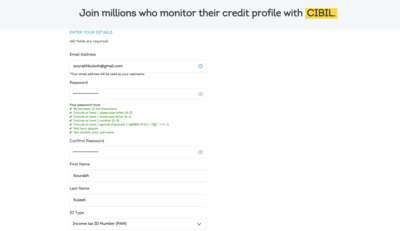

Visit the website of your preferred credit bureau (like CIBIL, Experian, etc.).

Login, or sign-up if you don’t have an account

Enter Details: Provide the required financial and personal data.

Verify: Enter the OTP sent to your registered mobile number.

Review the Report: Your credit score and a detailed report will be displayed.

When you get the report, look for any unknown loans, credit card applications or sudden inquiries. These pointers can suggest that your PAN may have been used without your knowledge.

Also read: Hack of the Day: Stop apps from tracking location in the background

Disclaimer: Hacks are based on verified public sources. Readers are advised to follow the official websites and updated rules.

A Permanent Account Number (PAN) card is more than just a piece of ID; it's an essential government document crucial for virtually all financial activities in India. Indian citizens need it to open bank accounts, register property, file taxes and much more. With India becoming a digital-first economy, scammers can find ways to steal information and misuse your PAN card.

Here in this article, we’ll understand what PAN card fraud is and how to check whether your PAN number is being misused by someone else.

What is PAN card fraud

In simpler terms, a PAN card fraud is the unauthorised use of an individual's PAN. Once fraudsters have your number, they can engage in a range of illegal activities, including identity theft, creating unauthorised bank accounts, securing fraudulent loans or credit cards, executing illegal transactions and even filing false tax returns. Such misuse can lead to severe financial losses and legal trouble for PAN card holders.

How to check if your PAN card has been misused

Regularly checking your credit score is the best way to catch fraud. Here are two ways you can check whether someone else is using your PAN.

Method 1:

Open your UPI app like GPay or CRED on your phone

Look for option that allows you check your Credit Score

Tap on it and give necessary access to the app

The app will display your score. Look for ‘Full Report/ Report’ option

When you get the report, look for any unknown loans, credit card applications or sudden inquiries. These pointers can suggest that your PAN may have been used without your knowledge.

Also read: Hack of the day: Set app time limits to stop endless scrolling

Method 2:

You can also check your Credit Score online:

Visit the website of your preferred credit bureau (like CIBIL, Experian, etc.).

Login, or sign-up if you don’t have an account

Enter Details: Provide the required financial and personal data.

Verify: Enter the OTP sent to your registered mobile number.

Review the Report: Your credit score and a detailed report will be displayed.

When you get the report, look for any unknown loans, credit card applications or sudden inquiries. These pointers can suggest that your PAN may have been used without your knowledge.

Also read: Hack of the Day: Stop apps from tracking location in the background

Disclaimer: Hacks are based on verified public sources. Readers are advised to follow the official websites and updated rules.

You may also like

Skinny to strong: 25-year-old youth shares incredible 4-year-journey of bulking up naturally

Bengal's Rajbangshi community welcomes SIR, keeping land concerns over political alignments

CorporatEdge leases 51,000 sq ft in Gurgaon, expands to Dubai

Effective Study Strategies to Boost Exam Performance

'I caught my husband cheating but I've allowed it to continue for one reason'