A year after SEBI clamped down on “lucrative” F&O trading, the cracks are now beginning to show for discounting broking platforms – plummeting revenues, an impending breakdown of the free trading model and diminishing margins.

The numbers tell the story of how deep SEBI’s cut has been:

- Zerodha saw revenues crash 40% in Q1 FY26, while top line tumbled 15% YoY to INR 8,500 Cr in FY25

- Angel One’s revenues dropped 19% YoY to INR 1,140 Cr in Q1 FY26, with profits plunging 61% YoY to INR 111 Cr

- Even Groww couldn’t escape the blow, witnessing a 17.4% YoY decline in fee income to INR 728 Cr in Q1 FY26

The Subsidy Model Breaks: For years, discount brokers offered zero-cost equity delivery, no account maintenance fees, and unlimited research tools – all bankrolled by F&O trading, which generated most of their revenue. However, SEBI’s regulations, including a higher securities transaction tax on options, an increase in the basic service demat account limit, and increased upfront margins, have now rendered this subsidy model obsolete.

A looming SEBI proposal to introduce weekly expiry dates for F&O contracts could further exacerbate troubles for these giants.

Pivot On The Cards? Discount brokerages are scrambling to adapt. Zerodha is hinting at reintroducing equity delivery charges, while Angel One is banking on its offline network to prevent further drain of investors. Groww, on the other hand, is diversifying into margin trading, personal loans, and mutual funds to keep the damage in check.

But, as SEBI moves to further curb speculative derivatives, can these pivots generate enough revenue to replace what’s been lost, or is India’s discount broking era nearing a standstill? Let’s find out…

From The Editor’s Desk Dhan Joins The 2025 Unicorn Club With $120 Mn Round

Dhan Joins The 2025 Unicorn Club With $120 Mn Round

- Dhan raised $120 Mn in a mix of primary and secondary funding led by Hornbill Capital and Japan’s MUFG, pushing its valuation past $1.2 Bn — nearly 10X since 2022.

- Founded in 2021, Dhan offers multiple financial services through its Option Trader app, algo-trading services via DhanHQ API, and other AI-driven tools.

- The fintech more than doubled its profits in FY25, posting a PAT of around INR 400 Cr versus INR 177 Cr in FY24, and its revenue jumped 2.4X YoY to nearly INR 900 Cr, reflecting strong topline momentum.

Wakefit, Lenskart Get SEBI Green Light for IPOs

- SEBI has cleared the IPOs of D2C furniture brand Wakefit and eyewear giant Lenskart. Wakefit plans to raise up to INR 468 Cr via fresh issue, while Lenskart targets INR 2,150 Cr via its primary public offering.

- Wakefit aims to expand its retail footprint to 117 new stores and shore up marketing spend, while Lenskart plans to strengthen its offline presence through company-owned stores.

- The approvals come amid a busy IPO season for Indian startups, with seven new-age tech companies, including Urban Company, Smartworks, Ather and BlueStone, listing on the D-Street so far this year.

IPO-Bound Flipkart Exits Aditya Birla Lifestyle Brands

IPO-Bound Flipkart Exits Aditya Birla Lifestyle Brands

- Flipkart Investments sold its entire 6% stake in Aditya Birla Lifestyle Brands via a block deal worth a nifty INR 998 Cr, offloading 7.3 Cr shares at 136.45 each.

- ABLBL houses lifestyle brands like Louis Philippe, Van Heusen, Allen Solly, Peter England, Simon Carter, American Eagle, and parts of Reebok. Flipkart had initially acquired a 7.8% stake in ABFRL in 2020 for INR 1,500 Cr.

- The stake sale coincides with Flipkart filing papers to reverse flip to India. With its IPO just round the corner, its marketplace arm crossed INR 20,000 Cr revenue in FY25 and trimmed losses by 37%.

Zappfresh IPO Finally Crosses The Line

Zappfresh IPO Finally Crosses The Line

- After an extended IPO, Zappfresh finally made it through with 1.36X oversubscription, with non-institutional investors oversubscribing 2.06X, while retail investors undersubscribed their quota at 96%.

- Initially scheduled to close on Sept 30, the company’s public issue was extended until Oct 6 amid a tepid investor response. To draw more interest, Zappfresh also trimmed its IPO price band to INR 95–100 from the earlier INR 96–101.

- In FY25, Zappfresh’s net profit nearly doubled, rising 94% YoY to INR 9.1 Cr from INR 4.7 Cr in FY24. All eyes are now on how the company fares when it lists on October 9.

Cashify Turns The Corner, Slashes Losses 80% In FY25

Cashify Turns The Corner, Slashes Losses 80% In FY25

- Cashify trimmed its net loss by 80% to INR 10.6 Cr in FY25 from INR 53.3 Cr in FY24, driven by higher revenue and improved margins.

- FY25 saw Cashify’s operating revenue rise 17% YoY to INR 1,096 Cr and total revenue, including other income, hit INR 1,122 Cr. Expenses rose 12% due to higher procurement costs.

- The recommerce startup, founded in 2013, operates an online platform for selling refurbished electronics and providing repair services, with revenues from both streams contributing almost equally to its top line.

Goldman Sachs Sells Eternal Stock, Again!

- Goldman Sachs has sold yet another 8.1 Cr shares in Eternal in a block deal worth INR 266.1 Cr. The shares were offloaded at INR 328.45 apiece, a 2% discount from its closing price of INR 335.05.

- The shares that flooded the market offloaded were lapped up by BofA Securities Europe SA.

- This comes as Goldman Sachs has been selling the foodtech major’s shares in droves. The financial services giant has netted INR 920 Cr+ from four block deals involving Eternal in the last month alone.

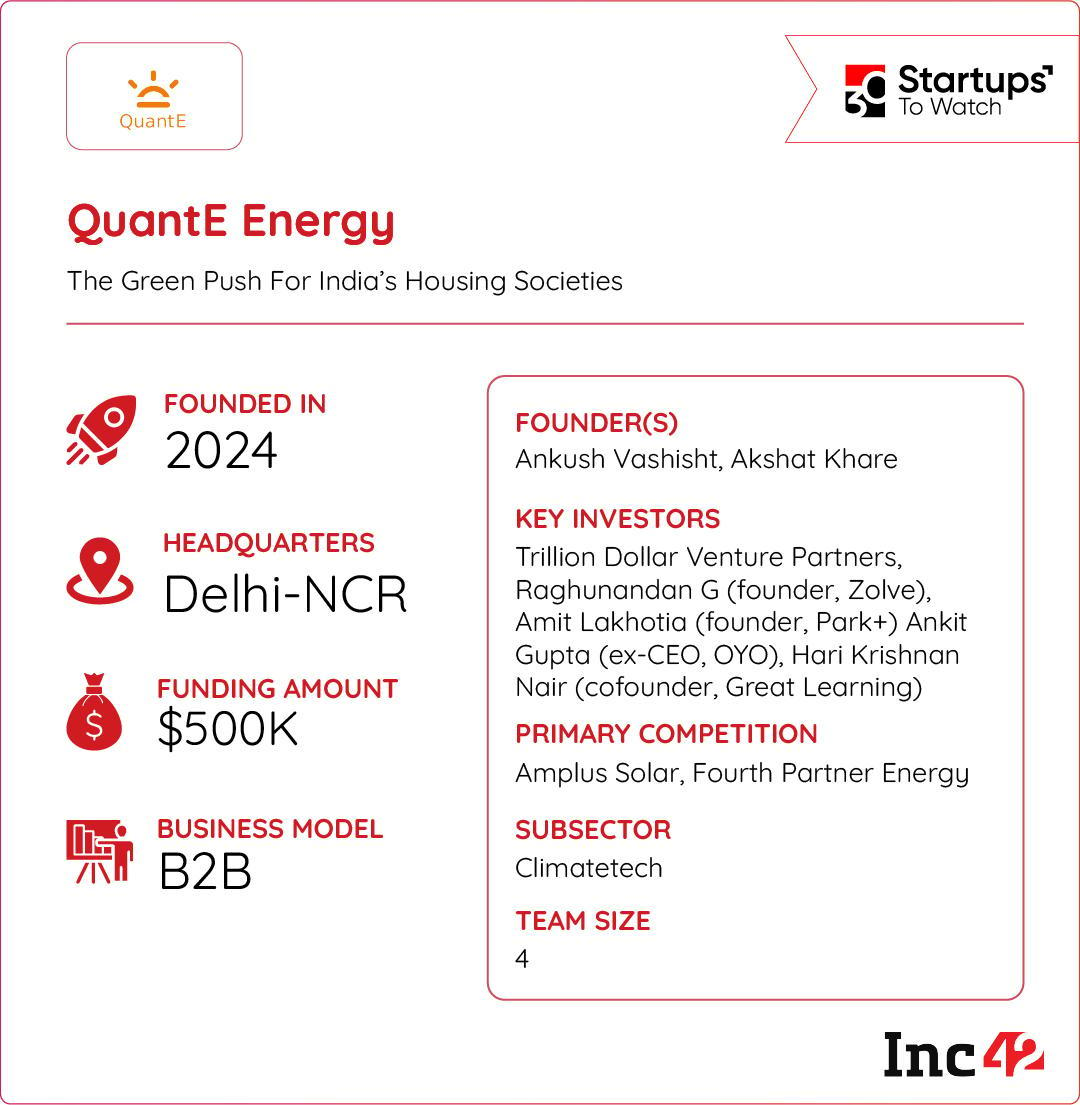

Adopting rooftop solar solutions remains effectively out of reach for the majority of Indian housing societies due to factors such as high upfront installation costs and poor servicing. QuantE Energy aims to solve this problem with its innovative business model.

Pay As You Go: Founded in 2024, QuantE operates on a subscription-like model, enabling housing societies to pay for the solar power they consume without bearing any upfront installation costs.

QuantE’s Solar Stack: Its integrated platform also makes clean energy adoption simple and reliable by bundling financing, service, and performance guarantees with IoT-based monitoring, predictive maintenance, and EV charging support. This offers societies real-time insights into their energy consumption and carbon savings, making the transition to green power simple, affordable, and scalable.

Making Hay While The Sun Shines: QuantE claims to have successfully piloted its offerings in multiple residential societies across Delhi NCR and Mumbai. By drastically lowering the barriers to adoption, can QuantE transition Indian residential societies to the clean energy era?

The post The Discount Broking Slide, A New Unicorn & More appeared first on Inc42 Media.

You may also like

Three civilians, including woman, forcibly disappeared from Balochistan: Rights body

Teddington School incident: Mystery as 'lots of police and ambulances' swarm to scene

Tej Pratap Yadav to Announce Candidates on October 8, Vows Focus on Bihar's Development

Action was taken against Nupur Sharma, but in Sanatan's case… what did the lawyer who hurled a shoe at the CJI have to say?

Grand Alliance Finalizes Bihar Seat-Sharing, Mukesh Sahni Pushes for Deputy CM Post