Eyewear titan Lenskart is gearing up for its biggest move yet — a public markets debut. It has received the shareholder nod to raise INR 2,150 Cr ($248.7 Mn) through a fresh issue, part of thebroader $1 Bn IPO that will also comprise an offer for sale component.

Making Strategic Moves Ahead of IPO: The shareholder approval comes amidst a flurry of strategic manoeuvres. The company’s board recently granted in-principle nod to issue equity shares worth INR 430 Cr to certain investors, while also allotting 72.8 Lakh shares to eligible employees under an ESOP scheme.

Meanwhile, SoftBank’s Sumer Juneja has stepped down from the company’s board, while Sayali Karanjkar and Ashish Kashyap have joined as independent directors.

Lenskart’s Attractive IPO Proposition: What works for the eyewear giant is its undisputed leadership in the country’s organised eyewear market. A strong blend of online presence and an expansive network of over 2,500 physical stores across India, the UAE, Singapore and Japan also makes its IPO an attractive proposition.

Making a strong case for its listing is also its marginal net loss of INR 10 Cr in FY24 against an operating revenue of INR 5,427.7 Cr, up 43% YoY.

A Future-Proof Gamble: No longer just a retailer, the eyewear giant is trying to become a tech company. Recently, it announced a partnership with Qualcomm to launch its next generation of AI-powered smart glasses. It also plans to leverage the emerging tech to build virtual try-ons and optimise inventory management.

With AI set to add extra sparkle to its IPO play, Lenskart has bagged the green light from shareholders to go public.

From The Editor’s DeskKrutrim Axes 100 Jobs: The AI unicorn has laid off 100+ employees in the second round of job cuts as part of a “strategic realignment” and an attempt to build leaner teams to manage resources better. The layoffs primarily impacted the company’s linguistics team.

Astra Shuts Shop: Four months after raising capital from Perplexity founder Aravind Srinivas, the AI-focussed SaaS startup has shut down after disagreements between cofounders and rising competition. Astra offered an AI-powered sales analytics platform for businesses.

PhysicsWallah Vs Scholars Den: The Delhi HC has referred a defamation suit filed by the edtech major against rival coaching institute to mediation. This comes after PW sued Scholars Den for calling the edtech platform “Sasta Wallah” (cheap one).

Amagi Slashes FY25 Losses: The IPO-bound SaaS unicorn trimmed its consolidated net losses by 71.9% to INR 68.7 Cr in FY25 compared to INR 245 Cr in FY24. The company’s operating revenue also zoomed 32.2% YoY to INR 1,162.6 Cr.

LEAP India Gears Up For IPO: The supply chain solutions provider has roped in UBS, Avendus Capital, IIFL and JM Financial as lead managers for its upcoming IPO. The company plans to file its DRHP with SEBI within the next few days.

Go Digit’s Profitable Q1 Show: The insurtech company reported a net profit of INR 138.3 Cr in Q1 FY26, up 37% from INR 101.3 Cr in the year-ago quarter. The company’s gross written premium stood at INR 2,982 Cr in the quarter under review, up 12% YoY.

Kenro Eyes A Stake In Pine Labs: The former Peak XV executive’s VC firm is in talks to invest $30 Mn to $40 Mn to pick up a stake in the fintech major. This comes as some of Pine Labs’ early backers look for a partial or full exit ahead of the fintech’s INR 2,600 Cr IPO.

Drizz Nets $2.7 Mn: The testing automation startup has raised the capital in its seed round led by Stellaris Venture Partners. Founded in 2024, Drizz is a SaaS platform that helps developers write, run, and maintain end-to-end test coverage using simple English prompts.

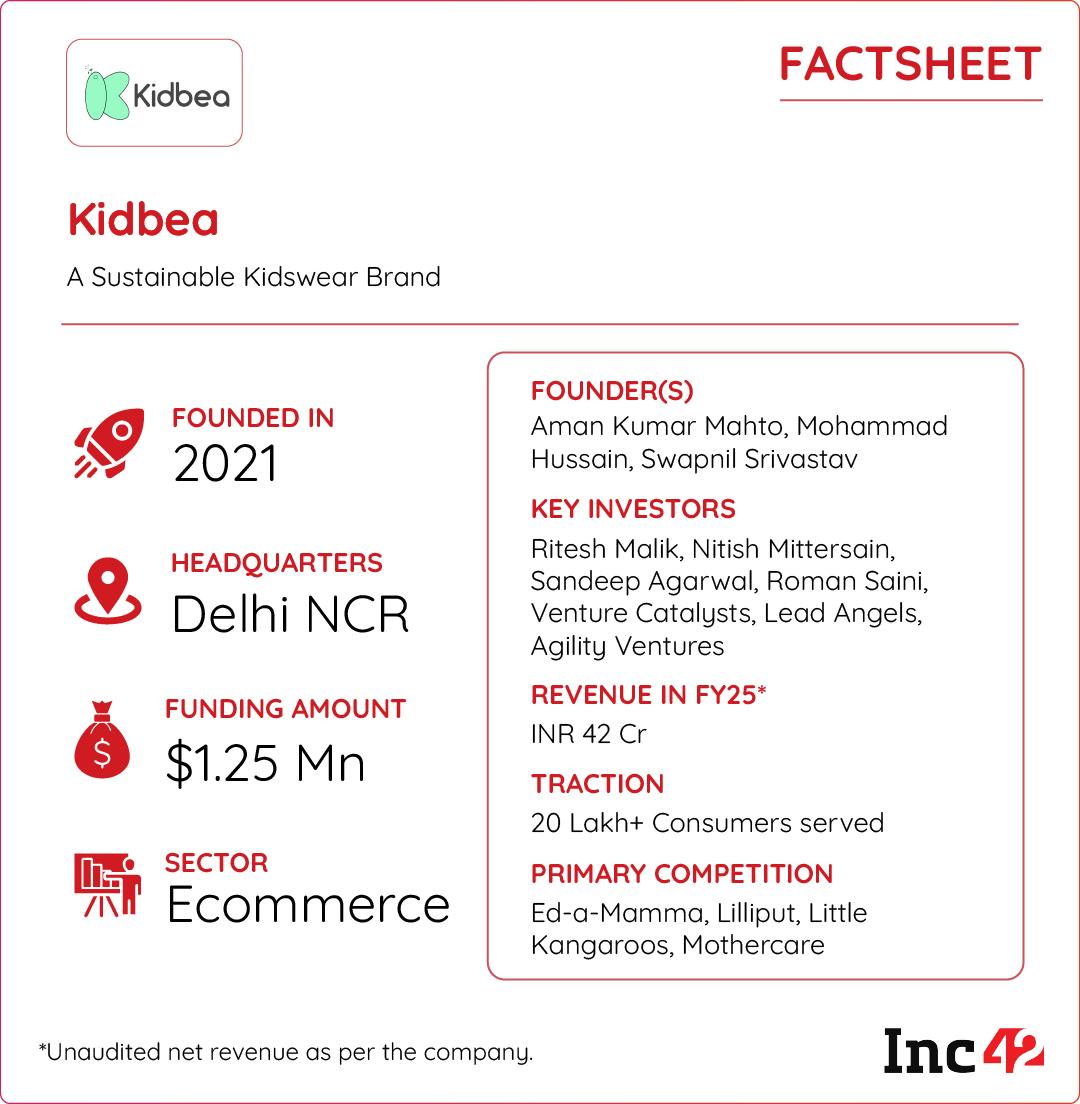

Inc42 Startup Spotlight Inside Kidbea’s Sustainable Spin On India’s $24 Bn Kidswear MarketIndia’s booming kidswear market is flooded with products, but only a few prioritise safety, sustainability and comfort. As parents grow more conscious of their children’s skin health and environmental impact, the demand for chemical-free, eco-friendly clothing is on the rise. Yet, most options are expensive or rely on imported fabrics, making them inaccessible to the masses.

A Sustainable Disruption: Kidbea fills this crucial gap by offering bamboo-based, ultra-soft, antibacterial and chemical-free clothing for children at affordable prices. Its certified organic range spans rompers, toys, feeding bottles and more.

Small Clothes, Big Mission: With India’s $24 Bn kidswear market growing steadily and the green fashion segment set to cross $3 Bn by FY30, Kidbea is poised to ride the dual wave of sustainable living and D2C disruption. Offline channels contribute 60% of its sales, with a growing presence on marketplaces like Myntra and FirstCry.

Backed by top investors and profitable at INR 42 Cr revenue in FY25, Kidbea is expanding into ethnicwear, scaling inventory with AI, and targeting INR 100 Cr in FY26. Can it lead the change with its sustainable spin?

The post Lenskart Sets Sights On IPO, Krutrim Cuts 100 Jobs & More appeared first on Inc42 Media.

You may also like

Countdown begins for NISAR – NASA ISRO Synthetic Aperture Radar Mission

'Busy with election campaigning': Kharge slams PM Modi over Pahalgam response; calls for resignation of those 'accountable'

Netflix fans so 'speechless' by film based on a true story they've watched twice

Loose Women star addresses Harvey Weinstein 'sex contract' that left her 'devastated'

Tommy Robinson flees UK hours after he's seen next to unconscious man at St Pancras