A year ago, delivering quarterly profit seemed like a distant dream for Paytm. Hit by the RBI’s crackdown on the fintech major’s associate, Paytm Payments Bank, in January 2024, the company seemed to be in a state of doldrums.

Degrowth in revenue, decline in the number of merchants and rising losses hurt the company for the most part of 2024. It reported a consolidated net loss of INR 840 Cr in the first quarter of FY25.

Now, a year later, the Vijay Shekhar Sharma-led company has reported a net profit of INR 122.5 Cr in Q1 FY26. While the company did post a profit of INR 930 Cr in Q2 FY25, it was due to the sale of its entertainment ticketing business to Eternal (then Zomato).

So, what changed over the past year? The answer is it decided to bring back its focus on the payments business.

In a bid to become a super app with multiple offerings, Paytm probably diversified a bit too much. The regulatory crackdown gave it an opportunity to relook at its business. Consequently, Paytm decided to exit the non-core business.

Over the last year, it sold Paytm Insider to Zomato and its stake in Australian-based PayPay to SoftBank. To outline the company’s future course of action, CEO Sharma reiterated multiple times that it is focussed on payments.

“Keeping the payments-led super app concept is better than calling super app first, payments second,” he said in the Q4 FY25 earnings call.

The move to double down on the payments vertical, coupled with the use of AI to cut costs, is finally showing results.

Payments Business Accounts For Over 50% RevenuePaytm reported an operating revenue of 1,917.5 Cr in Q1 FY26, an increase of 28% from INR 1,501.6 Cr in the year-ago quarter. Of the total operating revenue, around 54% came from the payments business.

Notably, the payments business is not just important for Paytm because of the revenue it brings but also because it helps the company cross-sell other services. Paytm earns revenue from the payments business through the payment processing fees it charges for card transactions and other services. While the company is among the top three apps in the UPI ecosystem, it earns a small amount from it in the form of UPI incentive from the government in the absence of MDR.

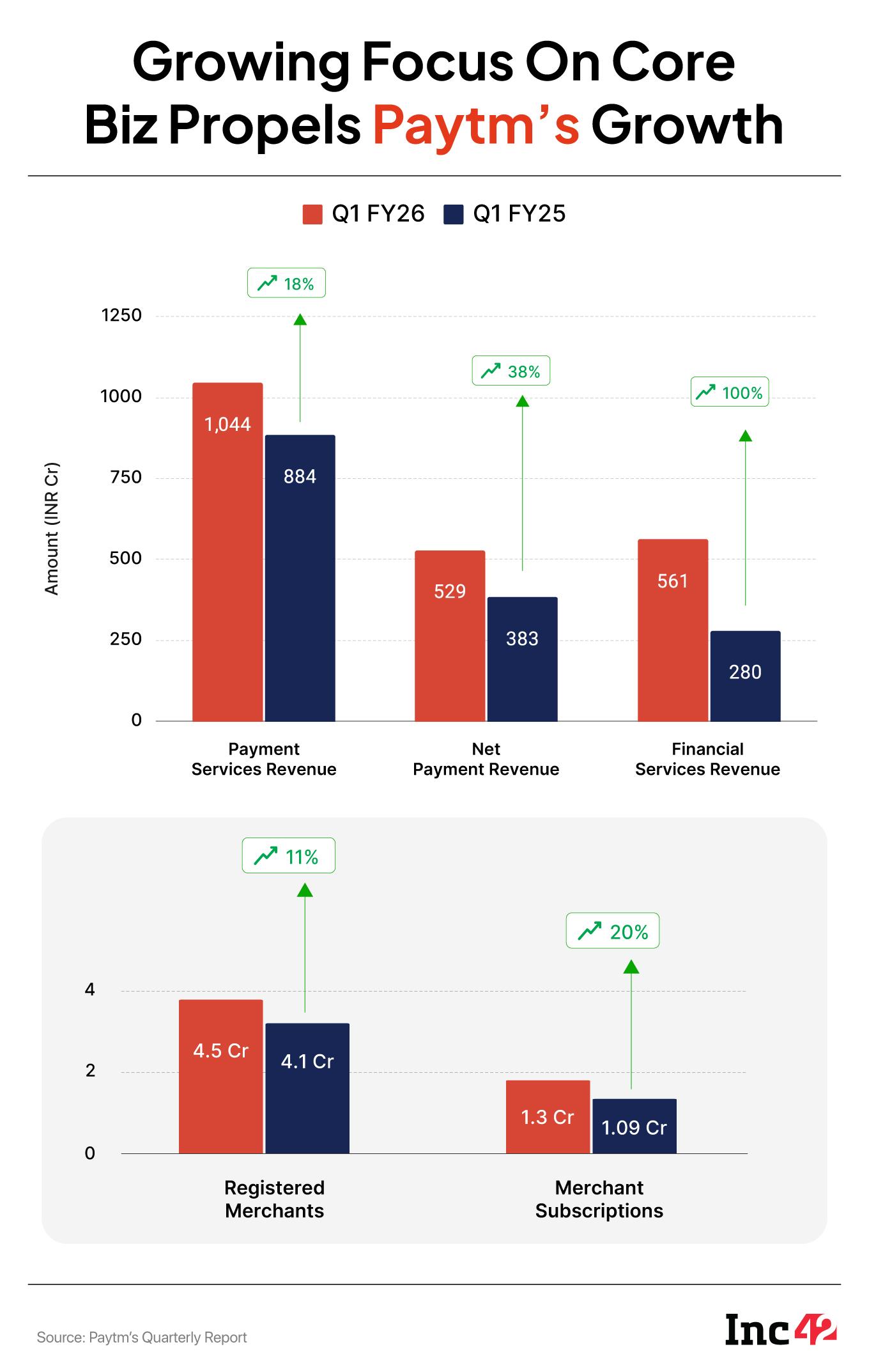

The other, and probably the biggest, source of revenue from this vertical is the subscription fee which it charges from merchants. Paytm’s registered merchant base rose 11% YoY to 4.5 Cr in the June quarter. The company provides an end-to-end payments tech stack, including hardware, software and other services, to these merchants.

Paytm’s push for merchant subscription was seen during the quarter under review, with its user base of merchants with subscriptions seeing a 20% YoY growth to 1.3 Cr. To bring more merchants into its subscriber base, Paytm has lowered device cost (Soundbox) and ramped up refurbishment of old devices.

This increase in subscription base resulted in Paytm’s payments service revenue jumping 23% YoY to INR 1,110 Cr. Net payment revenue zoomed 38% YoY to INR 529 Cr due to an increase in payment processing margin and device additions. Net payment revenue comprises payment processing margin and subscription revenue.

The fintech giant sees plenty of headroom for future growth as it believes that potentially over 10 Cr merchants will accept digital payments, of which 40- 50% will need subscription services for managing their business needs.

In a bid to further strengthen its tier I market position and expand to tier II & tier III cities, Paytm is investing in expanding its sales network. Helping in this expansion would be the company’s cash balance of INR 12,872 Cr at the end of the June quarter of 2025.

As mentioned above, the increase in its merchant base also helped the Noida-based company augment its revenue from the distribution of financial services, which includes loans, equity broking and insurance services.

The revenue from distribution of financial services doubled YoY to INR 561 Cr in Q1. As a result, the share of the financial services revenue in Paytm’s operating revenue increased to 29% from 18.6% a year ago.

Most of this revenue came from providing loans to its merchants, as equity broking and personal loans to consumers saw a slowdown during the quarter.

Paytm said the revenue from financial services grew as it saw robust growth in merchant loan disbursements coupled with trail revenue from default loss guarantee (DLG). However, the majority of merchant loans during the quarter were distributed under the non-DLG model, with more than 50% of loans distributed to repeat borrowers, reflecting strong product-market fit.

Cost Control By Leveraging AIWhile the growth in payments and financial services business helped the company, pruning of expenses, especially indirect costs, played an important role in the company turning profitable.

Paytm’s indirect expenses dropped 30% YoY to INR 1,079 Cr in Q1. The decline was higher than the 18% YoY fall in its total expenses in the quarter.

In the indirect expenses, the cost of non-sales employees was the biggest expenditure. However, it declined 28% YoY to INR 346 Cr, as the company continued to leverage AI for improving productivity.

Paytm also managed to trim its overall employee expenses 32% YoY to INR 642.6 Cr. Notably, as per reports, the company undertook a massive restructuring exercise over the past year due to the rising use of AI to automate processes. This resulted in hundreds of layoffs.

Besides, Paytm’s push for AI platforms such as Paytm ARMs (merchant lifestyle insight platform) and Paytm Pi (fraud and detection platform) has automated merchant onboarding, fraud detection, segmentation and pricing optimisation. These platforms have turned out to be a high retention flywheel and lifetime merchant value, as per the company.

Paytm has also been leveraging AI for marketing, which was reflected in a 65% YoY drop in its marketing expenditure to INR 62 Cr in the June quarter.

By reporting quarterly profit, Paytm has proved naysayers wrong. The next challenge for the company would be to not only sustain this profitability but also expand its bottom line.

Edited by Rai Vinaykumar

The post How Refocussing On Payments Biz Helped Paytm Turn Profitable appeared first on Inc42 Media.

You may also like

BREAKING: Prince William halts summer break to make huge announcement

Labour claim we can confidently brand BS and the one man who can fix problem

Chhatarpur's 18-Year-Old Kranti Goud Receives 'Player Of The Match' From Captain After Stunning 6-Wicket Haul In India's Win Over England; Watch Touching Video

England Lionesses penalty complaint launched by Italy in major Euro 2025 accusation

Fake Income Tax Emails Target Taxpayers With Refund Scams, Warns PIB Fact Check Unit