As widely expected, the Federal Reserve on Wednesday delivered its first interest rate reduction of 2025. Will the central bank continue to meet expectations by lowering rates two more times before the year is over? Don’t count on it.

Expectations in futures markets are an oversimplification of what is essentially a binary path for interest rates: One that gives markets what they want, and another increasingly likely path that could mean the Fed has delivered all the cuts we’re going to get in this calendar year.

Consider the Fed’s so-called dot plot, an anonymous depiction of where the seven Federal Reserve Board members and 12 Federal Reserve Bank presidents see rates heading. The most popular statistic is the median dot, which echoes the market’s expectation for two more rate cuts.

A close look at the distribution shows that the dots overwhelmingly fall into just two camps: one group of six that thinks Wednesday’s reduction is sufficient for the year, and a (for now) larger group of nine that expects two more cuts. (Rounding out the projections are two policymakers who saw one more cut, and two extreme outliers: one calling for a wholly implausible 125 basis points of additional easing and, at the opposite end of the spectrum, another whose dot implied that the Fed shouldn’t have moved on Wednesday.)

So which of these two binary outcomes is most likely at the moment? The answer comes down to the labor market.

The more dovish group of policymakers seems to be relying on the observation that the labor market is, in the words of Fed Governor Christopher Waller, “nearing stall speed.” They don’t deny that tariffs are nudging consumer prices higher at the moment, but they see them as a temporary factor that policymakers should look through. To support their argument for cuts, these doves can point to the recent weakness in payrolls data.

Their argument is complicated by the fact that the labor supply has been under pressure, principally due to new immigration restrictions, deportations and the related climate of fear among non-citizens. Companies may be hiring fewer people simply because there are fewer workers available to them, so policymakers including Federal Reserve Bank of Chicago President Austan Goolsbee have advocated for focusing on ratios instead of payrolls.

Notably, the unemployment rate is still just 4.3%, a number that would have been celebrated in earlier years and decades. The hires rate, at 3.3%, is uninspiring, but it’s been in a similar range since mid-2024. And the layoffs and discharge rate is similarly stable at around 1.1%. Meanwhile, initial jobless claims — the most high-frequency of the major labor market statistics — totaled an unremarkable 231,000 in the week ended Sept. 13, according to Labor Department data released Thursday. An alarming jump in the same statistic one week earlier turned out to be a head-fake, driven by fraud in Texas.

To the extent that the economy and labor market weakened in recent quarters, it’s also possible that the effects are now waning and that dovish Fed policymakers risk making a rearview mirror assessment of policy.

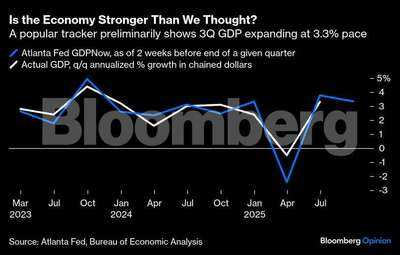

Retail sales rose in August for a third month, and consumption is finally expanding again on an inflation-adjusted basis, after stagnating in the first half of the year. While the quarter isn’t yet over, the Federal Reserve Bank of Atlanta’s GDPNow tracker shows third quarter gross domestic product on pace to grow at a 3.3% annualized pace. For all its many limitations, that tracker has often outperformed private sector economists in our hard-to-forecast post-pandemic economy. The stock market, while never a great barometer for economic activity, is at an all-time high, supporting household wealth and underpinning future spending.

One interpretation is that the US economy briefly sputtered from the uncertainty caused by President Donald Trump’s “Liberation Day” tariffs, but has now more or less found its footing again. Given lingering policy headwinds, it’s doubtful that the economy is about to go gangbusters, but stories of growth’s outright demise seem equally hyperbolic based on the available data.

One interpretation is that the US economy briefly sputtered from the uncertainty caused by President Donald Trump’s “Liberation Day” tariffs, but has now more or less found its footing again. Given lingering policy headwinds, it’s doubtful that the economy is about to go gangbusters, but stories of growth’s outright demise seem equally hyperbolic based on the available data.

If the dovish bloc in the dot plot is proved wrong by the incoming data, then the “no change” bloc will prevail by default. In practice, these policymakers have much in common with their more dovish colleagues. They recognize that inflation is a bit too warm, but they’re willing to look through the tariff impacts for the time being. They assess the labor market to be — to borrow from Chair Jerome Powell’s speech in Jackson Hole last month — in a “curious kind of balance that results from a marked slowing in both the supply of and demand for workers.” But they probably don’t take that tenuous balance for granted.

Regrettably, it’s impossible to ignore politics in addressing the outlook. Trump has been relentlessly calling for massive rate cuts (far in excess of what’s been discussed in this column); attacking Chair Powell on social media; and using the resources of the Department of Justice to try to remove Lisa Cook, a Fed governor with whom he disagrees on policy. Cook won the latest legal round against Trump in appeals court this week, but Trump has now asked the Supreme Court to let him fire her. The ultimate outcome will certainly weigh heavily on the outlook for Fed independence and data-driven policymaking.

For now, the Fed continues to be dominated by institutionalists, but it’s hard to believe that any member of the rate-setting Federal Open Market Committee can completely tune out the noise. Even the most noble and technocratic public servants are, in the end, only human. Nevertheless, this political influence will probably prove a wash for this year at least: Some voters may subconsciously lean dovish out of fear of retaliation from an activist administration, while others may subconsciously dig in their heels.

All in all, policy outcomes will remain relatively binary in the near-term: Either the labor market is cracking, or rate cuts are over for the time being. At the moment, the latter interpretation seems to have the advantage. That could be a reassuring outcome for American workers, but it’s bad news for dovish bond bulls and the president.

Expectations in futures markets are an oversimplification of what is essentially a binary path for interest rates: One that gives markets what they want, and another increasingly likely path that could mean the Fed has delivered all the cuts we’re going to get in this calendar year.

Consider the Fed’s so-called dot plot, an anonymous depiction of where the seven Federal Reserve Board members and 12 Federal Reserve Bank presidents see rates heading. The most popular statistic is the median dot, which echoes the market’s expectation for two more rate cuts.

A close look at the distribution shows that the dots overwhelmingly fall into just two camps: one group of six that thinks Wednesday’s reduction is sufficient for the year, and a (for now) larger group of nine that expects two more cuts. (Rounding out the projections are two policymakers who saw one more cut, and two extreme outliers: one calling for a wholly implausible 125 basis points of additional easing and, at the opposite end of the spectrum, another whose dot implied that the Fed shouldn’t have moved on Wednesday.)

So which of these two binary outcomes is most likely at the moment? The answer comes down to the labor market.

The more dovish group of policymakers seems to be relying on the observation that the labor market is, in the words of Fed Governor Christopher Waller, “nearing stall speed.” They don’t deny that tariffs are nudging consumer prices higher at the moment, but they see them as a temporary factor that policymakers should look through. To support their argument for cuts, these doves can point to the recent weakness in payrolls data.

Their argument is complicated by the fact that the labor supply has been under pressure, principally due to new immigration restrictions, deportations and the related climate of fear among non-citizens. Companies may be hiring fewer people simply because there are fewer workers available to them, so policymakers including Federal Reserve Bank of Chicago President Austan Goolsbee have advocated for focusing on ratios instead of payrolls.

Notably, the unemployment rate is still just 4.3%, a number that would have been celebrated in earlier years and decades. The hires rate, at 3.3%, is uninspiring, but it’s been in a similar range since mid-2024. And the layoffs and discharge rate is similarly stable at around 1.1%. Meanwhile, initial jobless claims — the most high-frequency of the major labor market statistics — totaled an unremarkable 231,000 in the week ended Sept. 13, according to Labor Department data released Thursday. An alarming jump in the same statistic one week earlier turned out to be a head-fake, driven by fraud in Texas.

To the extent that the economy and labor market weakened in recent quarters, it’s also possible that the effects are now waning and that dovish Fed policymakers risk making a rearview mirror assessment of policy.

Retail sales rose in August for a third month, and consumption is finally expanding again on an inflation-adjusted basis, after stagnating in the first half of the year. While the quarter isn’t yet over, the Federal Reserve Bank of Atlanta’s GDPNow tracker shows third quarter gross domestic product on pace to grow at a 3.3% annualized pace. For all its many limitations, that tracker has often outperformed private sector economists in our hard-to-forecast post-pandemic economy. The stock market, while never a great barometer for economic activity, is at an all-time high, supporting household wealth and underpinning future spending.

If the dovish bloc in the dot plot is proved wrong by the incoming data, then the “no change” bloc will prevail by default. In practice, these policymakers have much in common with their more dovish colleagues. They recognize that inflation is a bit too warm, but they’re willing to look through the tariff impacts for the time being. They assess the labor market to be — to borrow from Chair Jerome Powell’s speech in Jackson Hole last month — in a “curious kind of balance that results from a marked slowing in both the supply of and demand for workers.” But they probably don’t take that tenuous balance for granted.

Regrettably, it’s impossible to ignore politics in addressing the outlook. Trump has been relentlessly calling for massive rate cuts (far in excess of what’s been discussed in this column); attacking Chair Powell on social media; and using the resources of the Department of Justice to try to remove Lisa Cook, a Fed governor with whom he disagrees on policy. Cook won the latest legal round against Trump in appeals court this week, but Trump has now asked the Supreme Court to let him fire her. The ultimate outcome will certainly weigh heavily on the outlook for Fed independence and data-driven policymaking.

For now, the Fed continues to be dominated by institutionalists, but it’s hard to believe that any member of the rate-setting Federal Open Market Committee can completely tune out the noise. Even the most noble and technocratic public servants are, in the end, only human. Nevertheless, this political influence will probably prove a wash for this year at least: Some voters may subconsciously lean dovish out of fear of retaliation from an activist administration, while others may subconsciously dig in their heels.

All in all, policy outcomes will remain relatively binary in the near-term: Either the labor market is cracking, or rate cuts are over for the time being. At the moment, the latter interpretation seems to have the advantage. That could be a reassuring outcome for American workers, but it’s bad news for dovish bond bulls and the president.

You may also like

People like Sam Pitroda should be sent on a chartered flight to Pakistan: Shiv Sena UBT

'Face' of mystery woman found dead in woods who was never reported missing

775 senior citizens from Odisha embark on special pilgrim train to Ayodhya and Varanasi

Bhubaneswar's KIIT-KISS Join Hands With UNESCO MGIEP To Advance SDG Goals

BCCI president: High-power meeting in capital on 20 Sep holds the key